The June and year-to-date rallies are just the latest instances of stock markets confounding most forecasters. For several years now, many have anticipated an end to the economic expansion and bull market. High profile investment websites that survive on “click bait” have been negative for even longer. Since bad news drives more web traffic than good news, we would not expect that to change.

To be fair, there is plenty of material from which to paint a dire picture. We are ten years into a market recovery, approaching nearly the longest economic expansion on record, waiting on a hard or soft Brexit, confronted with Iran attacking ships in the Middle East, negotiating a new trade agreement with China, and looking at a yield curve and bond market that appear to be anticipating an economic recession. Put simply, the landscape and path forward for investors has rarely been so complicated. And we haven’t even mentioned the upcoming 2020 elections, which will be here before we know it.

Not Everything Is So Complicated

On the following pages we discuss the election and a few other topics upon which investors are focused heading into the second half of 2019 and 2020. Perhaps not surprising, we continue to believe owning a healthy amount of U.S. and international stocks makes sense for most investors. If you are uncertain whether you are one of those investors, or how much equity exposure makes sense for you, an update to your financial plan is overdue. Please let us help. Determining the appropriate financial plan to meet one’s long-term goals is part of what we do, and there is no better time to tackle the exercise than while markets are up.

Also in this commentary we’ll take a minute to ponder why even in these divisive times, Americans are excited to celebrate Independence Day and collectively paused on June 6th to remember the heroic D-day efforts of the 156,000 U.S. and Allied soldiers who stormed a 50 mile stretch of heavily fortified French beaches 75 years ago. Yes, there is a lot in today’s world that is complicated. Taking the time to honor the sacrifices and accomplishments of our World War II veterans is not.

Start normal MC Body below – let’s set off the above as an executive summary like we did several quarters back. We put it with a light blue background as I recall. Thx!

Federal Reserve Tightening: That Didn’t Last Long

In 2018, the Federal Reserve continued a plan to increase interest rates that began 2015. By November of last year, Ten Year U.S. Treasury yields reached 3.3% and the Two-Year Treasury’s yield peaked at 3.0%. Investors could earn 2.2% from a government money fund without principal risk. The long-anticipated climb in interest rates, however, now appears to be on hold. First, there was an indication in January that the Federal Reserve was willing to be more “patient” with regards to rate increases. Then at the Federal Reserve’s June 18-19 Open Markets Committee meeting the Chairman commented that the “case for accommodative policy is strengthening.” The Chairman’s conclusion was employment and manufacturing data had weakened enough to warrant consideration of a pause to the increases or even lowering of rates. While it is tough to see 3-5% corporate borrowing costs hindering economic expansion, we can appreciate how months of global trade uncertainty took its toll and started to be reflected in the economic data.

“The case for somewhat more accommodative policy has strengthened,” Federal Reserve Chairman Jerome Powell on June 19, 2019

Investors have taken these dovish comments to heart. For instance, Treasury prices have rallied to push the Ten-Year and Two-Year yields down to 2.0% and 1.8%. A one-year bank CD is back down to 2.3% after reaching 3.2% late last fall.

Understandably, some worry about the prospect of reintroducing monetary stimulus so soon after initiating a plan to tighten. Dallas Federal Reserve Bank President Kaplan noted following the meeting that he was “concerned that adding monetary stimulus, at this juncture, would contribute to a build-up of excesses and imbalances in the economy which may ultimately prove to be difficult and painful to manage.” Clearly, it is a tough time to be a risk averse saver. The challenges are even greater for savers in Europe and parts of Asia. For instance, the forty year Japanese government bond yields just 0.4%. Portugal now pays just 0.5% for its ten-year debt compared to the 18% it had to pay during the 2011 European crisis. German debt is the most expensive. Its yields are negative going out fifteen years.

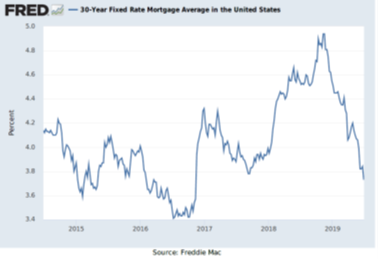

There is no way to tell whether we are stuck in this low rate world for decades to come, or if market forces or policy influencers return us to a more normal interest rate environment in the next few years. Consequently, we aren’t interested in owning long-dated bonds and have limited exposure to low-quality credits. For homeowners with mortgage debt, however, the Chairman’s case for accommodation has pushed mortgage rates to two-year lows creating an attractive window to refinance.

A Spread too Large to Ignore.

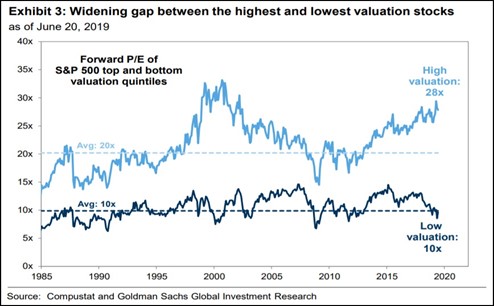

In our April Market Commentary, we discussed factors that influence the price equity investors are willing to pay for a stream of earnings and how this can translate into big gains and losses for the broader markets. In light of 2019’s strong first half, the discussion may be worth revisiting. It is available on our website at www.woodmontcounsel.com. While the April analysis focused on the S&P 500 as a whole, valuation discrepancies for specific industry sectors and companies can vary greatly. A company’s earnings growth profile and the sustainability and quality of those earnings should anchor most valuations. Increasingly, however, a company’s stock price hinges on the amount of investor funds flowing in and out of different passively managed investment vehicles.

Understanding the extent of the passive fund flows’ influence on stocks is difficult. Yet the latest asset management data illustrates how the influence is likely growing. According to J.P. Morgan’s fund flows update issued just last week, passive equity products are approaching 60% of all U.S. equity assets. If you add the 20% of funds tied to quantitative and algorithmic strategies that leaves just 20% of U.S. equity assets with a discretionary or active mandate. In the short run, this means stocks that are going up can keep attracting buyers with either no or limited regard for valuation or other important company fundamentals.

Certainly good companies growing faster demand a higher valuation. And arguably in an environment where earnings growth is tough to come by, those companies that are growing benefit from a scarcity of choices. Today’s divide between the most and least expensive stocks, however, now rivals the gap of the 2000 Dot-Com era and certainly seems inflated by the feeding of growth companies via passive fund inflows and the starvation of slower-growth value companies via active fund outflows.

Because we seek to preserve equity diversification among sectors, portfolios will include exposure to exciting, albeit more expensive, growth-oriented companies. For almost all clients, we’ll also continue to utilize tax-efficient and low-cost exchange traded funds. In the right context, these funds allow clients to effectively participate in the performance tailwind of compounding earnings growth over a long period of time. Yet considering the limited options to earn income in the bond market, sifting through those less expensive and quality dividend paying stocks the passive investment trend may have left behind should prove rewarding.

Presidential Campaign Season Already?

Ready or not, the race for the White House began in earnest last week with 20 of the 24 Democratic candidates gathering for debates in Miami. Equity investors at home and abroad are intently focused on the race and the extent to which any legislative proposals from the leading challengers and President Trump would represent wholesale changes to economic and trade policies or the tax code (the corporate section in particular).

This investor fixation on potential policy shifts was apparent earlier this year when a “Medicare for All” proposal appeared to be gathering steam. In about a week, the healthcare services index, which is comprised of insurers and providers, declined 12% before recovering when influential policy makers downplayed the proposal’s prospects for becoming law. Investors’ political preoccupation is not just to identify potential winning and losing sectors, but to understand much broader themes percolating within the electorate. What themes emerge between now and November 2020, including the extent to which socialism continues to gain popularity among younger voters in particular, will only add to an already complicated picture.

The Increased Anxiety Over Politics is Global. Anything We Can Do About It?

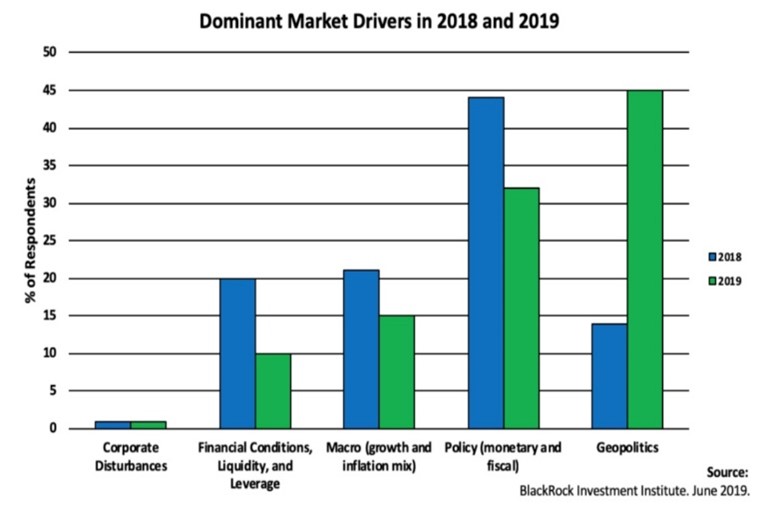

The race for the White House and fight for control of Congress will occupy more mindshare the next few quarters than any of us cares to admit. We are not alone in our angst over the current political climate. Politics has engulfed investors around the world. In fact, a recent BlackRock survey of investment managers and executives found that 45% of them believe geopolitics is the most significant market performance variable in 2019. This is up from just 14% in 2018.

Clearly it is going to take time for the geopolitics to be sorted out. However, it is worth trying to understand why there has been such a dramatic shift in a short amount of time in both the views for our capitalistic system and the politics that will influence it. As part of this exercise, the growing divide between CEO and typical worker compensation cannot be ignored. According to Compustat and the Bureau of Labor’s statistics, CEO’s of the 350 largest public firms make over 300 times the average employee’s salary, up from 52 times in 1990 and 20 times in the 1960’s. Certainly business is good, and corporate valuations are lofty. Despite today’s low unemployment, however, the middle manager, front line employee, and recent high school or college graduate are as anxious as ever when assessing their career runway.

Couple this increasingly visible discrepancy with the Congress to K Street glide path and it is easy to see how for many a frustration with politicians quickly evolved into a conclusion that our capitalistic system is broken. While admittedly painting with a broad brush, it seems public company shareholders and board members must consider the long-term implications of executive compensation packages that reflect poorly upon our capitalistic system.

A Strong Foundation Upon Which to Build

The old saying is “don’t miss the forest for the trees.” Granted, it can be tough to fully appreciate what’s special about the forest when the trees are swaying violently in the wind. This twist on the old saying may be analogous to our nation today, particularly as news about swaying trees tends to draw more internet clicks. As for our forest, we are not without our serious imperfections. Yet a recent radio segment, which sought to answer the question “What’s the Attitude about the U.S. on the Street in China?,” served as a great reminder of our still enviable ideals. Specifically, when asked to describe the United States in one word, the anonymous interviewees (these Chinese citizens generally didn’t want their names shared on air) used words such as “democracy,” “freedom,” “developed,” and “advanced.” These were hardly the descriptions one might expect given the current trade war and the fact the Chinese government controls the news. These words from outside observers, however, highlight how the principles upon which we were founded remain a powerful ideal to so many. While it is tough to always appreciate this amidst the trees, let’s remember it as we celebrate our independence this week.

Please let us know if you have questions or would like to schedule a time to meet and fine tune that equity assessment referenced above. Thank you for the continued confidence and best wishes to you and your family for a terrific Fourth of July Holiday.