While certainly worth enduring, the financial markets’ second half was not without volatility. Growing fears of a recession and an unexpected hike in Japanese interest rates sent global equity investors running for the exits in early August. A spike in the CBOE Volatility Index (VIX) captured this fear when it jumped from 23 on August 2 to 65 on August 5, reaching levels last seen during the 2020 COVID panic.

Amidst these considerable economic and policy uncertainties, U.S. large-capitalization stocks declined 10% from mid-July to early August. Later in the year, the typically more stable Dow Jones Industrial Average fell ten days in a row. The last time that happened was 1974.

The second half of 2024 may have tested the mental fortitude of bond investors even more than equity investors. After peaking in mid-September, the U.S. Aggregate Bond index shed nearly 5%. Long bonds such as the 10-Year Treasury, which suffer greatly when inflation fears spike, declined 10% from September to the end of 2024. Because investors hold bonds for income and capital preservation, the next round of Federal Reserve commentary and economic data will add to the anxiety, especially among long bond investors.

For several years, however, we have summarized three or four insights to help clients understand our perspective heading into a new year. These conclusions helped guide us in 2024, particularly the recognition that investors were far from “all-in” and current technology tailwinds were very different compared to the fleeting experience of the Dot-com stock bubble of the late 1990s and early 2000s.

Sticking with this format, we have drawn three new conclusions heading into 2025:

- With the “average” U.S. large-capitalization stock trading at 16X 2025 estimated earnings or a 25% discount to major market-weighted indices, investors can benefit from a broadening of the markets’ winners.

- The threat of inflation has not dissipated and fixed-income credit spreads are historically tight. Thus, the reward for taking significant interest rate and credit risks in bond portfolios is insufficient.

- Equity investors are certainly more “all-in” today than last year. This increased investor enthusiasm gives us some pause. Yet, we recognize business owners’ and entrepreneurs’ eagerness to risk capital and invest “sweat equity” will continue to benefit the U.S. economy and long-term investors.

We will expand on these three conclusions in the following pages. Of course, decades of investing experience and the market’s frequent surprises have taught us that investors should prepare for the unexpected. The significant appreciation of growth stocks in 2024 on the heels of a “magnificent” rebound in 2023 is just a recent example of how the consensus is often off-target.

“Success is not final, failure is not fatal: It is the courage to continue that counts.” - Winston Churchill

Understanding the market’s propensity to surprise investors does not necessarily mean we increased equity exposure during the August downturn to take advantage of this most recent run. Time horizons, taxes, and income needs are all factors we consider when materially adjusting portfolios. It does, however, mean we appreciate the rewards of committing to an appropriate investment allocation in the face of significant uncertainties. This has been a core tenant of Woodmont’s in the twenty-five years of business we will celebrate later this year. While not always easy, it is very much part of our psyche.

The S&P 500 Is No Longer a Diverse Equity Index.

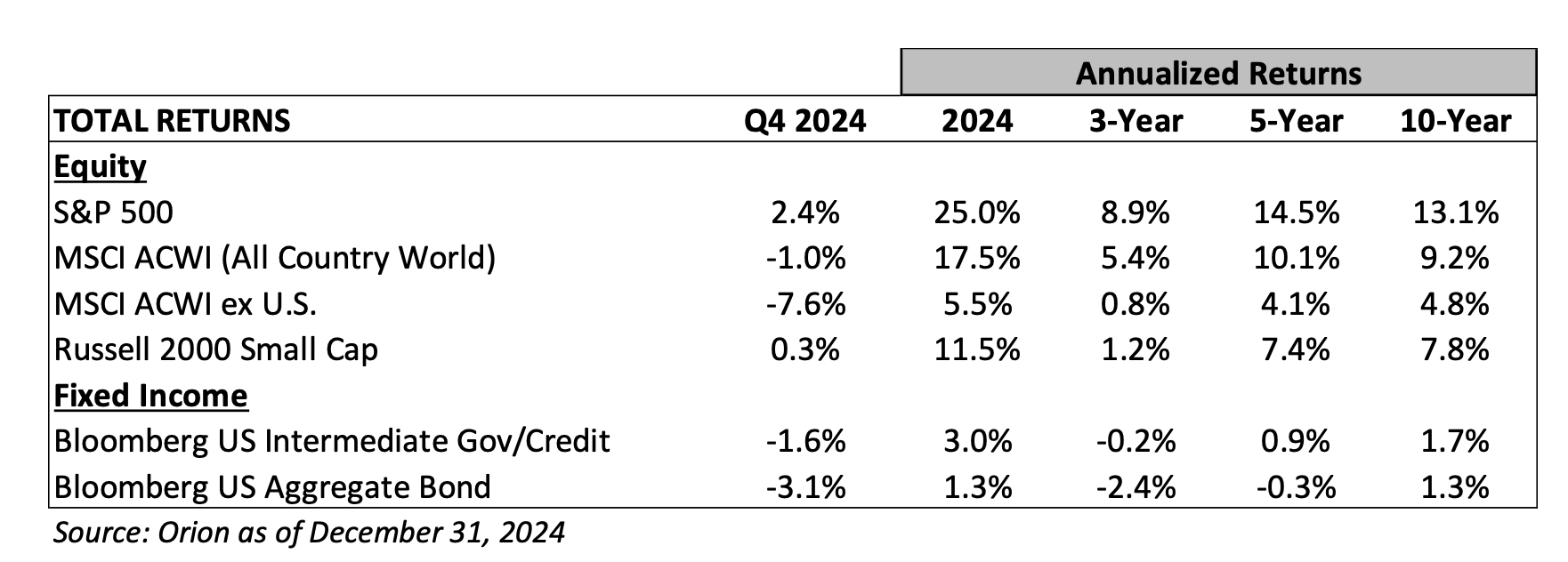

The S&P 500 has long been the major benchmark for U.S.-focused investors. Historically, it represented a diverse set of companies covering ten industries. The relative outperformance of a handful of companies in recent years has dramatically changed its composition. Specifically, the 10 largest constituents now represent 38% of the index compared to just 18% ten years ago. The three largest (Apple, Microsoft, & Nvidia) are currently 21% of the index. Technology stocks, in aggregate, are 33% of the index compared to 20% in 2014.

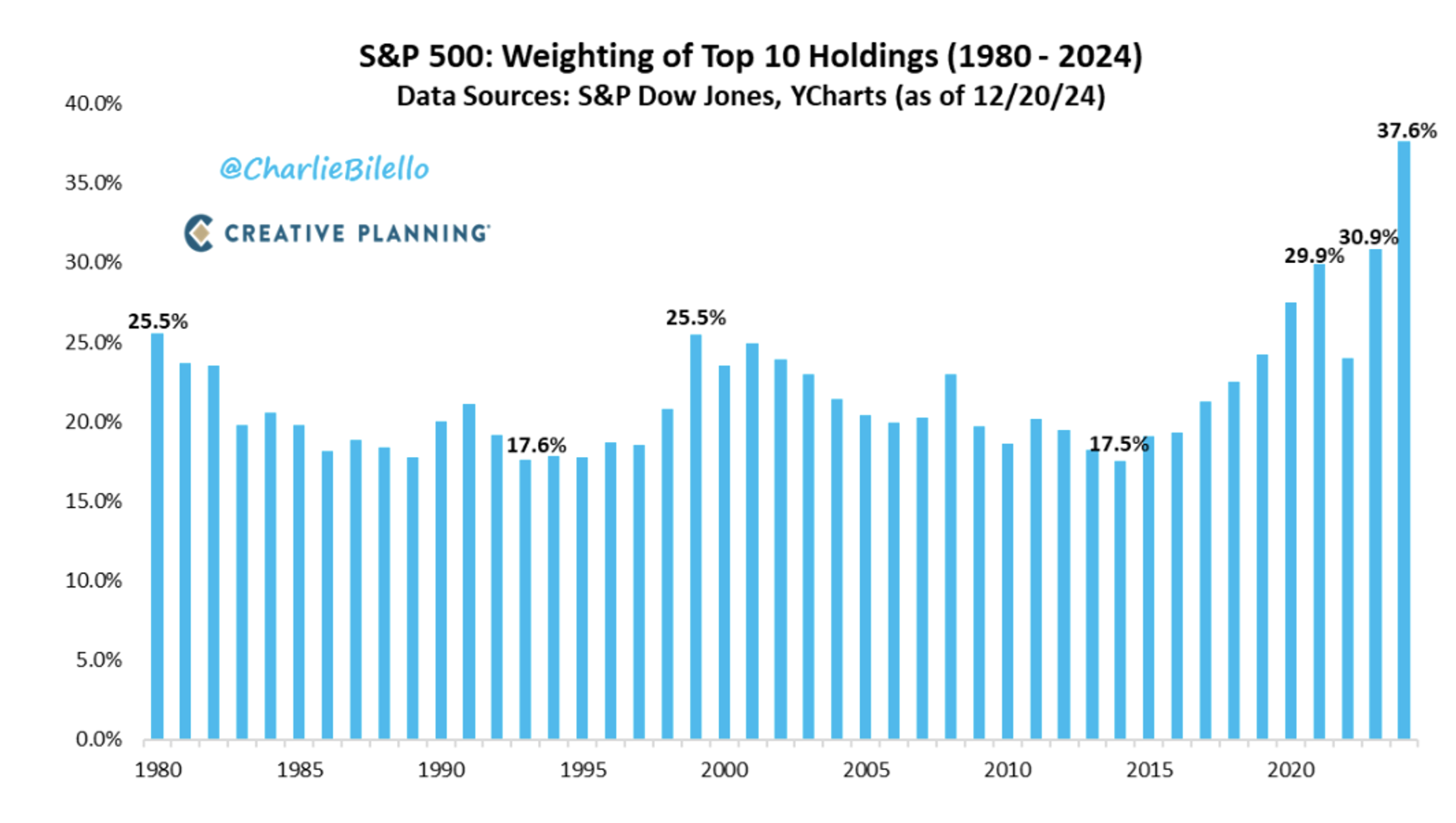

The gigantic companies behind this shift are incredibly high-quality and benefit from increased adoption of technology solutions and innovations inconceivable just a few years ago. In terms of productivity (i.e., doing more with less), the scalable solutions of these top companies and many of those outside the top ten are unlike anything we have seen. The chart below, which tracks the dramatic increase in revenue per employee, illustrates this shift. These technology-driven business models, versus the labor and more capital-intensive modes of the past, provide important context for the S&P 500’s relatively high 22X price-to-earnings (P/E) ratio and the roughly 30X at which the top 10 trade.

The growing performance dependency this concentration presents, however, cannot go unnoticed. This risk and the valuation discount of the other 490 companies in the index are why, for many clients, we have modestly tilted their portfolios to lower P/E multiple but still growing dividend-focused equities. More broadly, we have also sought to include modest allocations to mid-capitalization, small-capitalization, and non-U.S. stocks, all of which trade at or near historic discounts to their larger U.S. peers.

Importantly, our portfolios remain diversified by style and capitalization, including the uniquely positioned large-capitalization growth stocks that have served investors incredibly well during the past decade. Yet this tactical tilt should provide some peace of mind in the face of such high concentration levels, particularly for investors who prefer enhanced income visibility and seek to reduce volatility.

Few Things Sting Like Losing Money in Bonds. Thus, We Remain Conservatively Positioned.

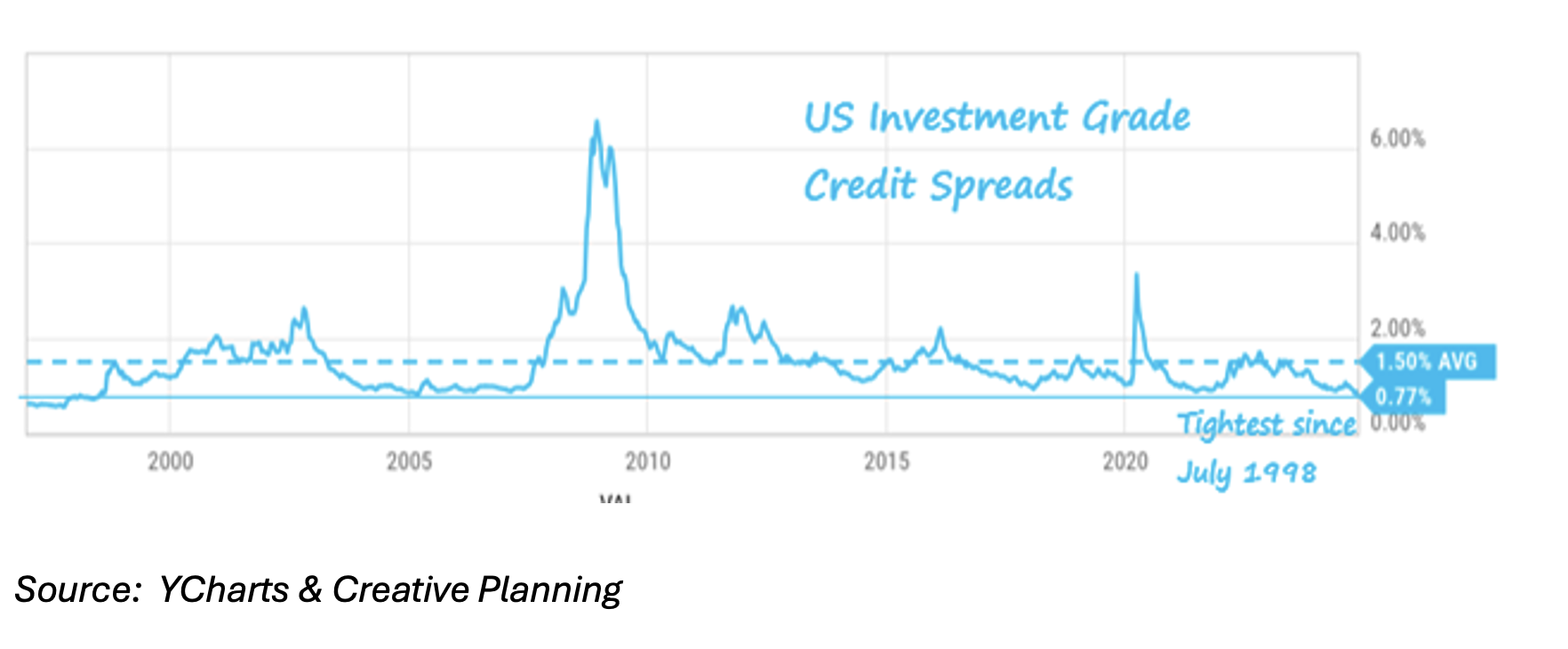

Despite the declines from mid-September through the fourth quarter, the Intermediate and Total Bond Indices managed gains of 3.0% and 1.3% for 2024. The modest gains provided little solace for investors who may have piled into long bonds in September when yields were lowest and prices highest. Investment drawdowns are never enjoyable, but they really sting when the conservative portion of one’s portfolio loses 5% to 10% in a few months.

Throughout 2024, many investors were understandably drawn to the relative safety of bonds and yields approaching mid-single digits. After all, the Federal Reserve had begun lowering rates (including an aggressive 0.5% cut in September) and the risks of an economic slowdown seemed to be increasing.

"I think we're in a good place, but I think from here it's a new phase and we're going to be cautious about further cuts." - Federal Reserve Chairman Gerome Powell, December 18, 2024

Today, the 10-year U.S. Treasury yields 4.6% compared to 3.8% in September and 3.9% a year ago. We believe the government bond sell-off reflects several mounting concerns. One concern we have often discussed is the risk of government deficits and debt – both at historic records by any metric. And, while the emerging Department of Government Efficiency is interesting in concept, entitlement reform appears off the table despite representing nearly 70% of annual government spending.

In addition to worries about deficits and debt, bond investors seem concerned the policy priorities of lower taxes and less regulation could increase consumer demand and business investment at a time when deportations and tariffs could constrain labor and the supply of goods. This potential for “too much money chasing too few goods” is textbook inflation, which we know is kryptonite for bond investors.

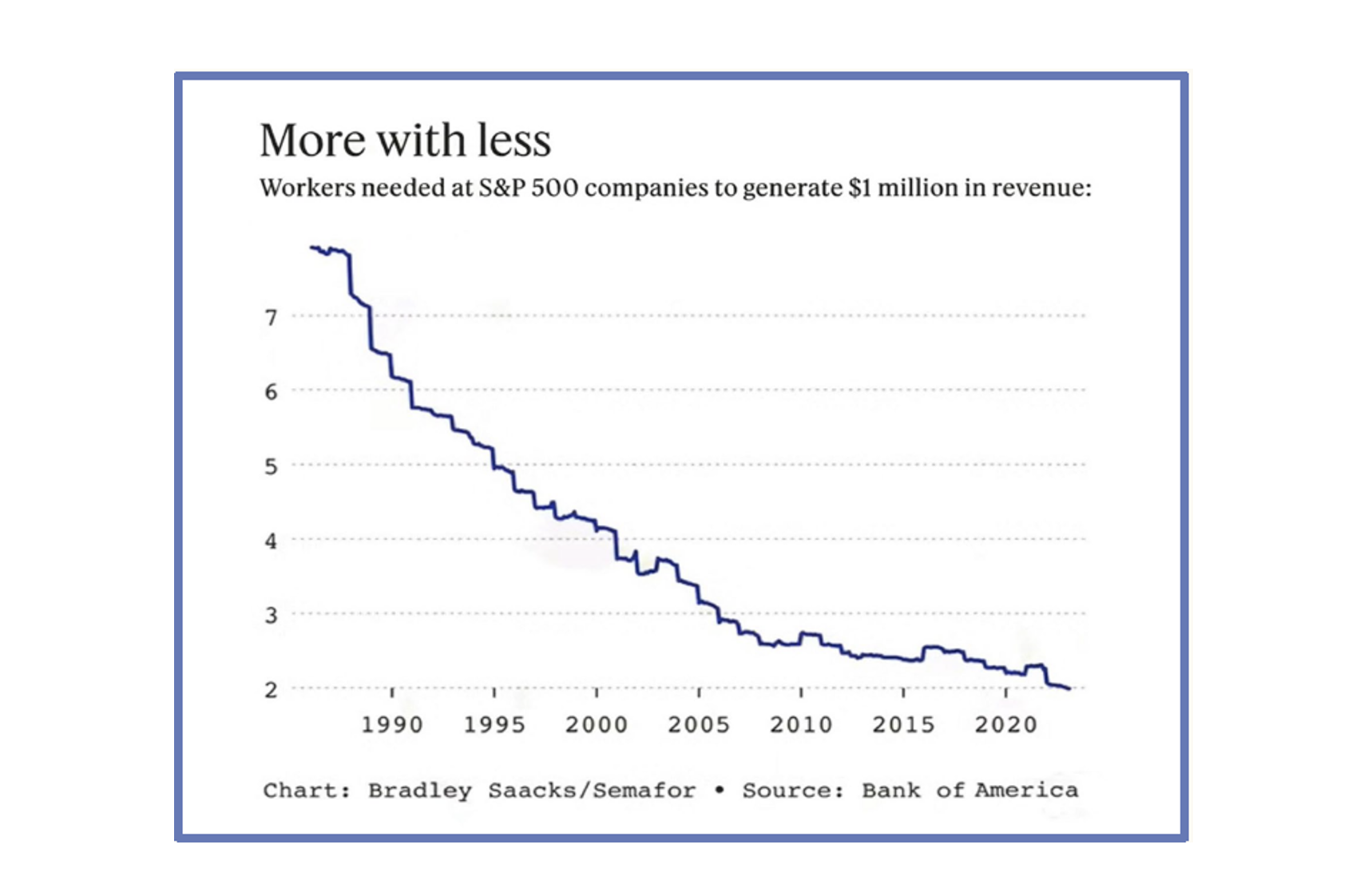

Meanwhile, the spread between corporate bonds and U.S. Treasury bonds, representing the premium investors demand for the additional risks, has remained tight. Expectations for continued economic growth and corporate balance sheets that, in many respects, are healthier than the U.S. federal government’s have contributed to these tight spreads. Of course, as strong as many of these corporate borrowers are, none can print money or levy taxes. Thus, we remain sensitive to the added risks of extending duration and sacrificing credit quality for little additional return when investing in both government and corporate bonds.

Economic Growth Depends on Investors and Entrepreneurs Taking Risks. We Get a Little Nervous When Everyone Is Doing It.

According to Edward Conrad at the American Enterprise Institute, the U.S. risk-taking culture is at the heart of the entrepreneurial successes and innovative spirit from which U.S. investors have long benefited. The fruits of this psyche are apparent when comparing corporate successes around the globe. For instance, despite higher academic test scores than in the U.S. (a presumptively important metric for economic growth and innovation), Europe has incubated fourteen companies worth $10 billion or more in the last 50 years. The U.S. has launched 250 over the same period.

“Where the prize is highest, there, too, will you find the best and the bravest.” - Pericles of Ancient Greece

We have often discussed the benefits of the U.S.’s can-do spirit, access to capital, intellectual property protections, and relative tax rates. These distinctions are a major reason our portfolios have been and remain overweight U.S. equities compared to the global benchmarks. A recent uptick in small business optimism and increased visibility on capital gains tax rates would seem to support the risk-taking culture required to fuel further economic expansion.

If anything gives us pause in considering the prospects for forward returns, it is the notion that the upside is greatest when fear is most palpable and asset valuations are low. Unfortunately, today’s elevated price-earnings ratios, tight credit spreads, and historically aggressive investor equity weightings may run counter to this thesis. And, while we remain enthusiastic for the long-term upside from innovations in technology, life sciences, and how businesses are finding ways to do more with less, increased investor appetite for digital assets, private credit, vacation clubs and sports franchises are arguably more reflective of activities observed in the later and not early innings of an economic expansion.

Are We Still Watching for the Sunset?

In August, we published a planning piece, One Sunset We’re Watching Closely. Its focus was the expiration of many important provisions of the 2017 Tax Cuts and Jobs Act (TCJA) at the end of 2025, absent new legislation. Of particular focus for many of our clients were the estate tax exemptions and a handful of tax provisions important to many business owners and real estate investors.

“What I’ve learned over the years is to respect how well the economy does despite Washington.” - Ed Yardeni, Wall Street Journal, 12/26/24

Prior to November’s election, the consensus was a divided Congress and/or a different party in the White House meant these provisions of the TCJA would sunset. With the Republicans winning the White House and taking both Houses of Congress, that sentiment shifted quickly. In fact, in the days following the election, the market quickly began to pick winners and losers based on expressed and assumed policy priorities of the new administration.

Fast-forward a few weeks, and some of that initial spike has reversed. For instance, two of the most often cited winners—energy and regional bank stocks—are down 15% and 12% from their respective November highs. Similarly, industrial stocks have given back nearly 10% of their gains. Large-capitalization technology stocks, which are expected to benefit from less regulatory scrutiny, have proven more resilient, finishing the year just 4% from their all-time highs.

As the negotiations surrounding the recent continuing budget resolution suggest, the legislative “sausage making” could be volatile and more public than usual. Put another way, while party leadership may have a vision, it is unclear how easily any leader can execute in this era of “politics by pixel” and the primary challenge threat. For investors, tax and regulatory policies are always closely watched. Lower taxes and fewer regulations appear to be on the priority list. Yet predicting the political psyche and potential bipartisan “bedfellows” will be as difficult as ever.

“Go out on a limb. That's where the fruit is.” - President Jimmy Carter (October 1, 1924 – December 29, 2024)

We end 2024 with news of the passing of former President Jimmy Carter at age 100. Many historians debate whether his contributions as a former President will outlast those of his administration. There is no debate, however, that President Carter’s transition from a Georgia farmhouse with no plumbing or insulation to the White House represents the potential for those who work hard, invest in relationships, and are unafraid to take risks when an opportunity presents itself. As a nation, we have long revered this psyche, and if we can continue to foster it, the prospects for 2025 and beyond remain bright.

Thank you, as always, for your trust and confidence. We wish you all the best and look forward to working with you in the new year.

The Woodmont Team

January 2, 2025

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.