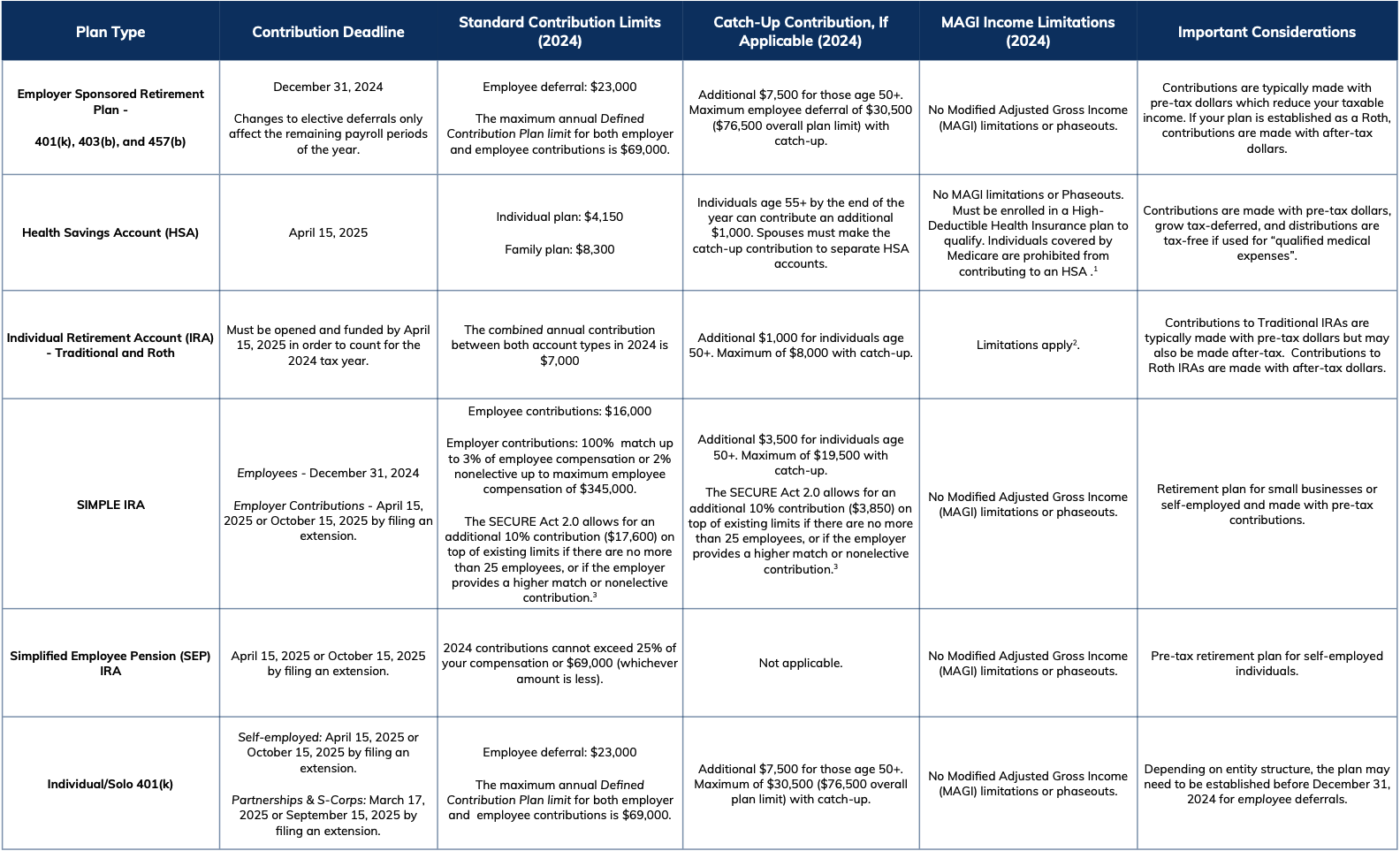

The tables below highlight key deadlines and important information on some of today's most popular account types. As always, your Woodmont Team is available to answer any questions on how these options may impact you. Links to Additional Resources:

- HSA Contribution Limits

- IRA Contribution Limits

- Secure 2.0 Act of 2022

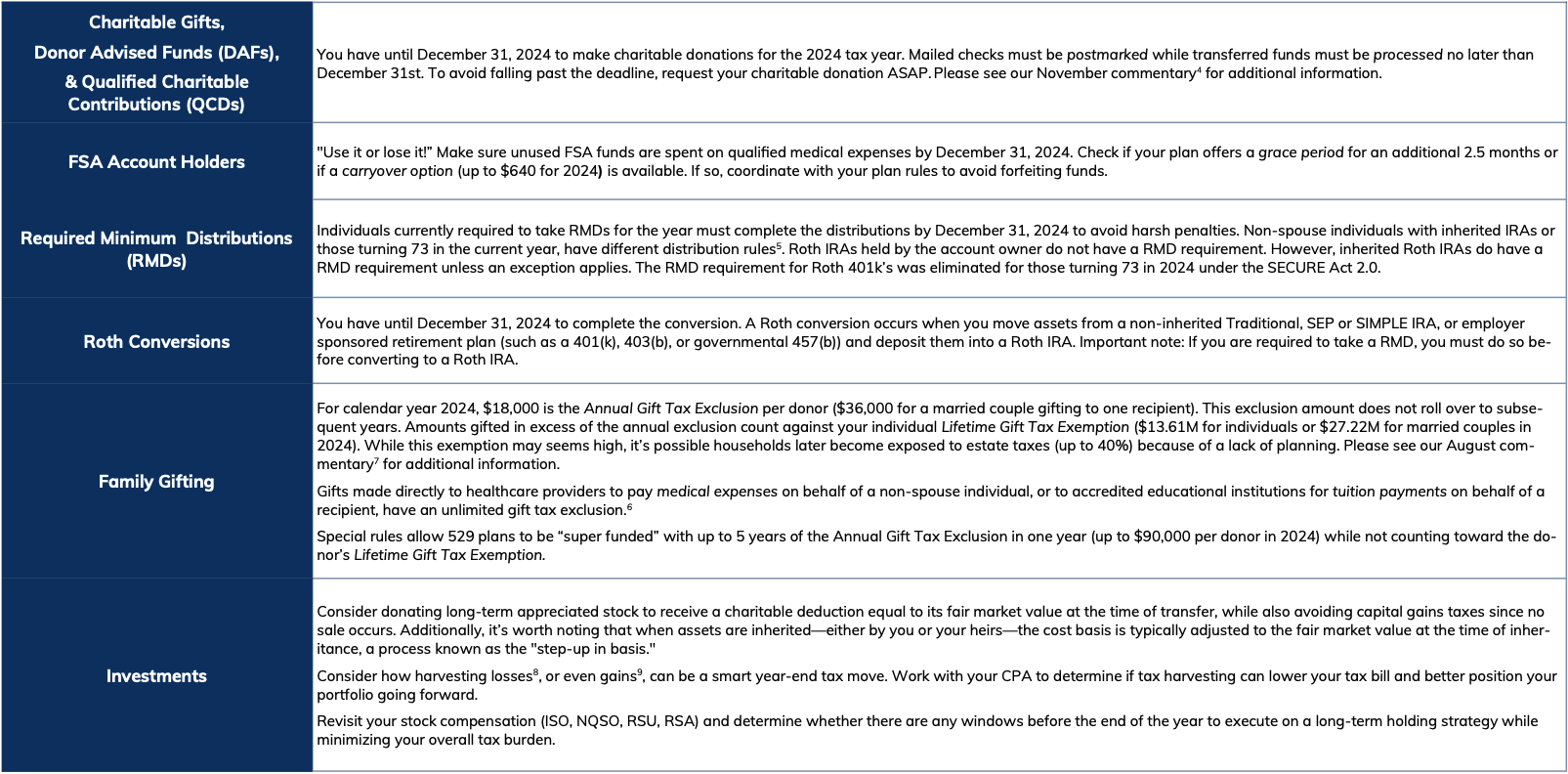

- Planning for Year-End 2024: Gifts and Distributions - Woodmont Commentary

- Required Minimum Distributions

- Frequently Asked Questions on Gift Taxes

- One Sunset We're Watching Closely - Woodmont Commentary

- Cut Your Tax Bill With Tax Loss Harvesting

- How to Lower Your Taxes by Harvesting Gains