This summer, the financial markets sprinted ahead at a record pace. Improved treatments for COVID-19, the prospects of a vaccine, and hopes for a V-Shaped economic recovery brought retail and institutional investors out in force. Small investors, many of whom were sheltering in place, opened millions of accounts at new online trading entrants such as Robinhood and Webull. While many of these first-time investors chased the stock of the day, others became active in financial derivatives, or as Warren Buffett calls them “weapons of mass financial destruction.” Not to be outdone, some institutional investors were active in the derivatives markets as well. Softbank, a Japanese conglomerate, reportedly bought $4 billion of call options tied to a basket of high-profile tech stocks. Many believe this unusually large derivatives activity contributed to August’s strong gains, particularly among large-cap tech stocks.

All told, the enthusiasm of these new investors, seasoned investors trying to keep up with the major market indices, and record fiscal and monetary stimulus resulted in the fastest Bull market recovery in history. As one observer noted, the entire round trip from a record high back in February to the March 23rd low and then to a new high in August was just 126 trading days. This compares to an average of 1,500 days to recovery since 1928.

With mounting uncertainty for how the distribution and uptake of a potential vaccine could work, not to mention the economic toll from our now nearly seven months long COVID-19 fight, a new reality could be setting in. That is, this COVID-19 fight and the ensuing economic recovery could look more like a marathon than a sprint. Regardless, the markets’ rapid ascent from the March bottom yet again reminded stock investors of the rewards of persevering through even the most harrowing of circumstances.

Included in this issue:

- The 2020 Headliner – Will It Still be COVID-19?

- Broadly Speaking, Investors Are Still Underweight Stocks

- Run Through the Tape!

The 2020 Headliner – Will It Still be COVID-19?

The race against COVID-19 is not the only competition that has captured the minds of investors this year. The other race is scheduled to be decided on November 3rd. Whether a winner is determined on that date remains to be seen due to the increased number of mail-in ballots, COVID-19 safety protocol, and electoral tensions unlike any we have seen in generations.

As to be expected, Wall Street is full of analysis predicting the markets’ winners and losers based on different election outcomes. To understand the difficulty and risks of this analysis one only has to recall election night 2016. The Dow Jones Industrial futures fell 5% before trading limits stopped the fall soon after President Trump was projected to win Florida, only to rally the next day representing a near 7% swing in less than twenty-four hours.

As for some of Wall Street’s political analysis, according to Strategas’ review of the historical data, a politically split Congress with a Democratic President has produced the best returns for the S&P 500 from 1933 to 2019. Considering investors can fear rapid change as much as anything, these strong results during periods of political gridlock may come as little surprise. Moreover, these historical results, and former Vice President Biden’s proposal to increase the corporate tax rate from 21% to 28% and establish a 15% minimum corporate tax rate, may also be why many investors are closely watching a few key Senate races and the fluctuating odds of a Democratic sweep.

For some context, a recent Jefferies analysis estimated Vice President Biden’s corporate tax proposal would reduce estimated 2021 S&P 500 earnings by about 15%. That would mean all else equal stocks currently trade at an adjusted 24X price to earnings ratio for 2021 estimated earnings versus today’s 20X.

The policy “sausage” usually looks very different upon completion versus proposal, and a desire to boost the economy ahead of the 2022 mid-term elections could temper a push for higher corporate taxes. It is worth noting, nonetheless, that Predictit Odds have the likelihood of a Democratic sweep at approximately 30%. This is consistent with the current betting odds.

Clearly, there are limitations to these political forecasts and any predictions for how the market might respond. So, if nothing else, we can at least hope that the Presidential and Congressional races are decided at the scheduled November 3rd finish line!

“It was the best of times. It was the worst of times.” Charles Dickens A Tale of Two Cities

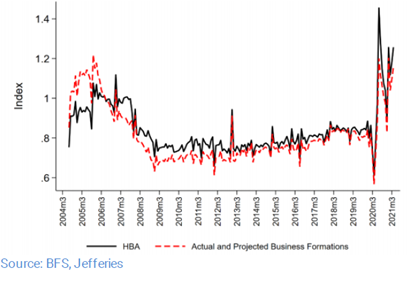

The year’s events have presented levels of cultural and economic dichotomy unlike any we have seen for generations. While historians and sociologists will be studying 2020’s cultural implications for years, many of the economic changes are already front and center. Industries dependent upon travel, entertaining large groups, and serving the office worker, are struggling to survive. Whereas eCommerce, work from home solutions providers, content creators, and single-family construction and home improvement companies cannot keep pace with the demand. Amidst 700,000 businesses failing this year, the Wall Street Journal notes applications for new business tax identification numbers has already exceeded 3.2 million. This is the most since 2007 and includes many displaced workers finding opportunities in the face of a setback.

The 2020 contrasts witnessed on economic Main Street are just as glaring in the major financial markets. Technology and consumer discretionary stocks have appreciated 28% and 22%, respectively. Energy and financials have declined 50% and 22% year-to-date. More broadly, the S&P 500 has gained 6% through the third quarter, although there are certainly winners and losers. Specifically, the large-cap growth index is up 26% compared to a 11% decline for the value index. Despite a U.S. Ten-Year Treasury that now yields just 0.7%, the FTSE High Dividend Yield Index, which currently yields 3.5%, is down 11% in 2020. Non-U.S. stocks continue to underperform with the FTSE All-World index down 4% year-to-date.

While the performance divide has closed in recent weeks as large-cap tech stocks have retreated from their August highs and a weaker dollar helped international stocks, the secular tailwinds benefitting many U.S. technology stocks remain strong. One potential risk for the high-profile group is increased government regulation. In fact, contempt for big tech and the distrust of China may be two of just a few things politicians can agree on these days. Representing 18% of the S&P 500, any scrutiny of the much-discussed FAANG (Facebook Apple Amazon Netflix Google) group could have implications for the performance of the major market indices. Add in Microsoft, which has entered the social media fray with its reported pursuit of Tik Tok, and this cohort is 23.5% of the S&P 500.

Broady Speaking, Investors Are Still Underweight Stocks

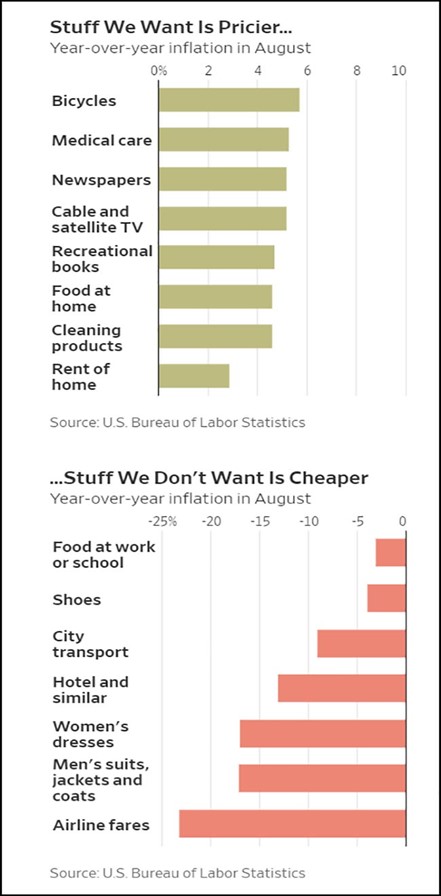

The M1 money supply (i.e., money in circulation including deposits at banks) is up 40% in 2020. A big source of this increased supply was the Federal stimulus in the form of both checks to individuals and loans, many of which are forgivable. While consumers spent a portion of their stimulus funds on both staples and discretionary items, the savings rate also increased dramatically. Banks have reported record consumer and business deposit levels, representing either savings for an even rainier day, or the funds needed to repay government loans if the forgivable criteria are not met. Considering bank savings accounts and CDs offer paltry, if any, interest and price inflation for the goods we want to purchase is running low to mid-single digits, the annual opportunity costs of parking this cash is not insignificant.

It is impossible to know how much of this cash will ultimately be invested in stocks and the implications. While the appeal of fixed-income securities remains limited, and may be for some time given the Federal Reserve’s goal to keep short-term rates near zero through 2023, there are other options for the cash including paying down debt and spending it.

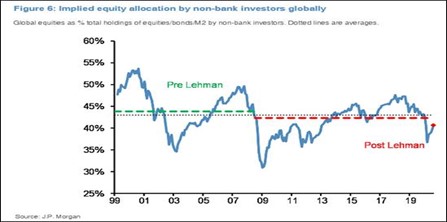

We know Americans are pretty good at spending! As for investing, it is interesting to note that according to Jefferies’ research 1) the amount of assets in active and passive equity funds is still well below February 2020 levels, 2) there is $840 billion more invested in money market funds than before COVID-19, and 3) per the J.P. Morgan data below U.S. and non U.S. equities as a percentage of investor portfolios are still below ten and twenty-year historical averages. Suffice it to say, if markets turn down in the coming months it is unlikely because investors don’t have cash to invest.

Run Through the Tape!

If the first nine months of the year are any indication, the fourth quarter of 2020 could prove eventful. The stock markets’ reaction is impossible to accurately predict in the short run. Any attempt could create unnecessary angst at best, and at worst, long-term financial damage. What we can control, however, is having an investment strategy and financial plan consistent with each client’s long-term financial goals and risk tolerance. Where that plan includes a need for income, the fact so many high-quality dividend stocks have lagged the broader indices presents an opportunity. For our growth-oriented investors, standing ready to increase equity exposure during periods of market downturns can significantly improve long-term risk-adjusted returns.

If we have not discussed your portfolio recently, or your circumstances have changed such that a review is in order, please contact us. It will help us finish 2020 and enter 2021 prepared for what are the inevitable twists and turns of investing. And while there will be periods when as investors we look more astute than we are, or in hindsight we wonder how an investment opportunity so obvious was missed, our commitment remains the same. We will put our clients’ interests first and run the race as hard as we know how.

Thank you for your continued confidence and all the best for a safe and rewarding fall season.