Five years ago this past quarter, investors panicked in the face of unprecedented health and economic uncertainties related to COVID-19. From February 19th to March 23, 2020, the S&P 500 and All-World indices declined 33%. This represented the most intense market drawdown in history. The economy came to a screeching halt, threatening to destroy even financially secure enterprises. We issued four market commentaries in six weeks to address the uncertainty and provide context for our investment decisions. While no less daunting to execute, these decisions were anchored to the time-tested strategy that lower prices and investor fear create opportunities.

As suggested by the recent market volatility and investor sentiment surveys, a less severe but certainly palpable level of panic set in this past February. The catalyst wasn’t a global pandemic but an escalating trade war, potentially signaling an end to globalization.

The post-World War II trend of increasing global integration has served U.S.-focused investors well. Ten years ago, the U.S. represented 52% of global equity capitalization and 24% of global GDP profits. At the recent February high, U.S. equities comprised 66% of global capitalization and approximately 26% of global profits. Suffice it to say that the combination of earnings growth and expanding valuation multiples proved powerful.

“Over the medium term…it’s a focus on Main Street. Wall Street’s done great, Wall Street can continue to do fine, but we have a focus on small business and consumers.” U.S. Treasury Secretary Bessent, March 4, 2025

Many support the “fair trade” objective of the evolving trade war, if not its policy tactics. Moreover, Americans’ longstanding emotional and familial connections to small towns, the urban core, and once thriving manufacturing hubs mean that Treasury Secretary Bessent’s comments regarding a Wall Street to Main Street shift in focus likely resonate. Yet most also understand the economic record for trade wars is poor and that automation has and will continue to alter the manufacturing landscape, regardless of trade policy.

In this commentary, we will review stock and bond valuations, evaluate the most recent economic data and earnings trends, and discuss tariffs. We will also share what we’ve learned about investor convictions and Main Street activity visiting with clients over the years. These conversations have proven insightful in previous periods of uncertainty and seem no less valuable today.

Quite the Reversal. Portfolio Diversification Finally Helped.

As of March 31, the S&P 500 stood 9% from its February 19th high, reversing all the indices’ post-election gains. Confidence has eroded quickly as business owners and investors watched the administration’s policy focus shift from anticipated pro-growth tax cuts and regulatory reforms to hard-to-gauge tariffs and a torrid pace of Federal workforce and agency cuts.

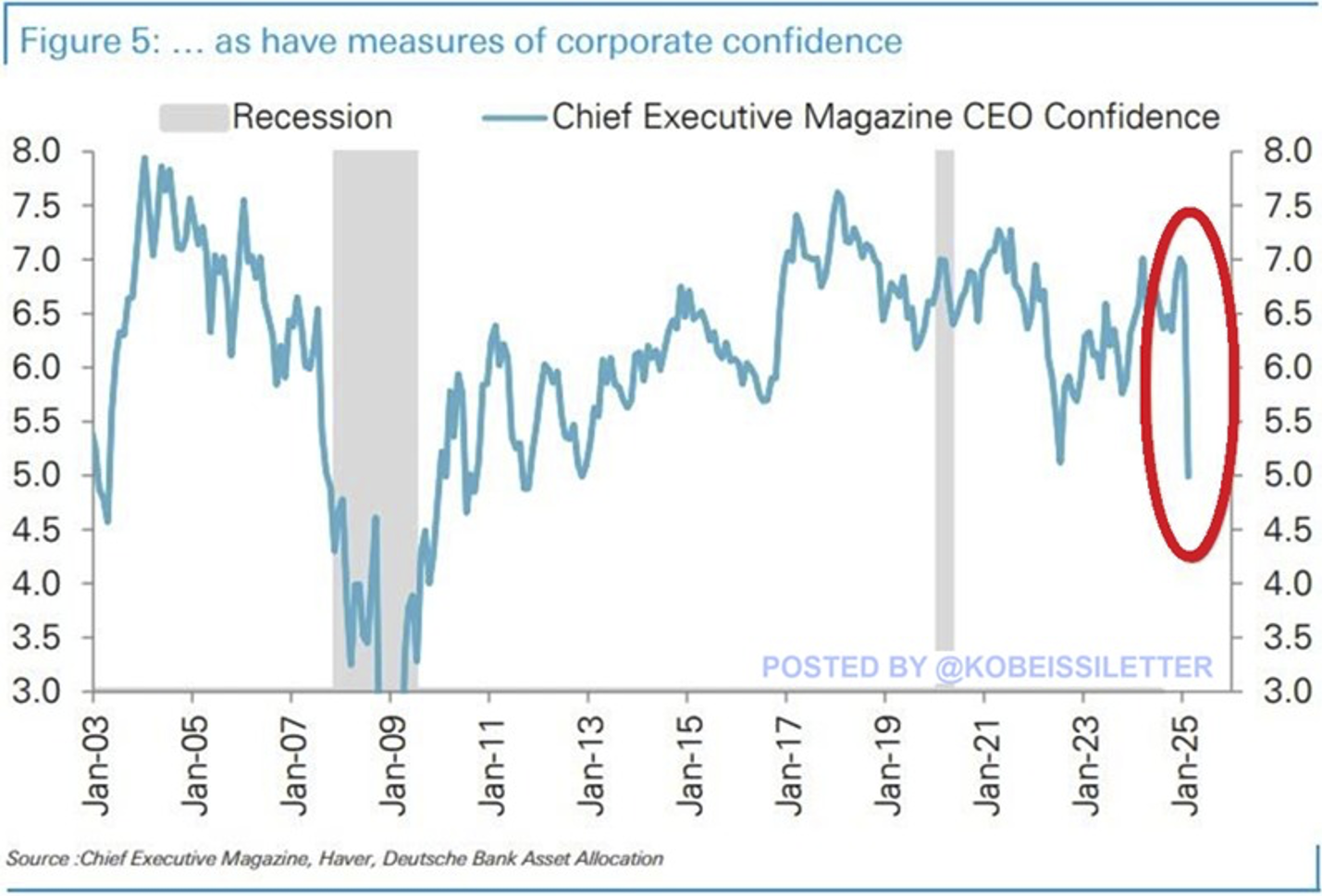

Source: Chief Executive Magazine and Deutsche Bank

On the heels of this shift, the NFIB’s Small Business optimism and the CEO Confidence indices fell to the worst level in over ten years. Investor sentiment, as tracked by the American Association of Independent Investors’ weekly survey, found just 19% bullish in early March compared to 38% on average for the past fifty years. The current investor angst is significant. Yet, while deteriorating optimism is a painful prerequisite to finding a bottom in any market correction, the fear has not reached past survey capitulation levels.

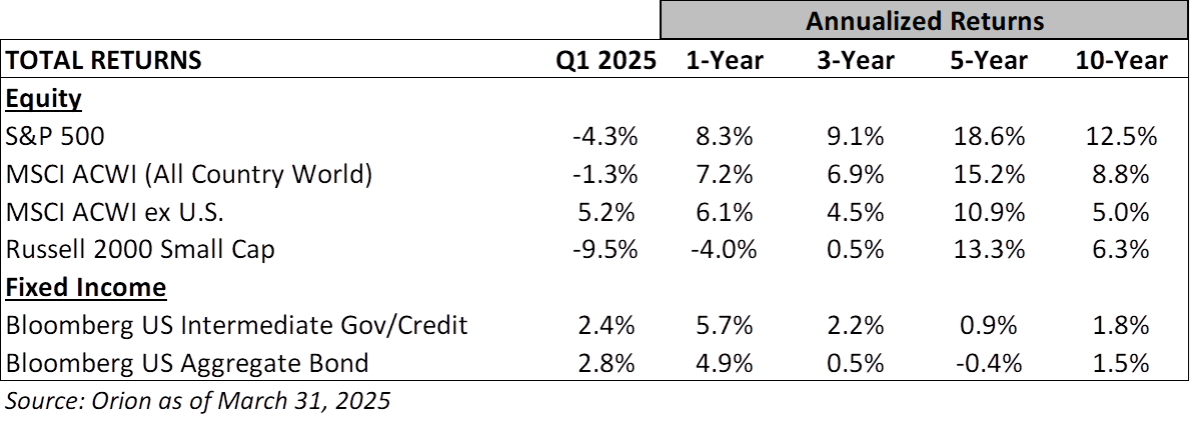

Despite the broad-based nature of the growing concerns, just seven stocks (the “Magnificent Seven” down 15% on average in the first quarter) accounted for nearly all the S&P 500’s first quarter’s 4.3% decline due to these companies’ concentration in the index. We discussed this capitalization concentration in our January Commentary. While it had served as a multi-year tailwind, making it difficult for diverse portfolios to keep pace with the S&P 500, the reverse proved true in the first quarter. In fact, the equal-weighted S&P 500 finished down just 0.7% to start the year. Buoying this index were many high-quality dividend-paying companies, which had trailed growth stocks in recent periods but historically outperformed in periods of uncertainty.

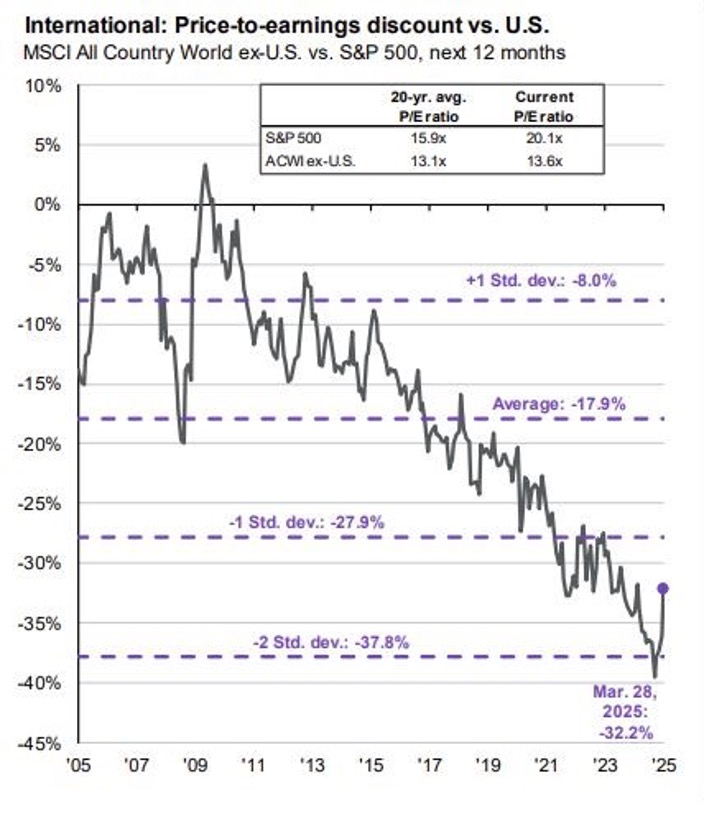

More noteworthy than the dynamics within the S&P 500, however, was the outperformance of non-U.S. stocks. The ex-U.S. benchmark gained 5.2% in the first quarter, even though the U.S. dollar held relatively steady for the time being. The non-U.S. equity gains provided a valuable first-quarter boost to diversified portfolios and are a reminder that portfolio diversification helps mitigate risks. Going forward, multiple factors support maintaining this diversification, including 1) the non-U.S. benchmark’s comparatively appealing 2.6% dividend yield (the S&P 500 yield is 1.3%), 2) the exposure offers a U.S. dollar hedge, and 3) the lower price-to-earnings valuation of 14X 2025 estimates versus the S&P 500 at 20X.

An Unforeseen Catalyst for Reforms?

The tariff and trade headlines have catalyzed a range of reactions around the world. While critical self-reflection is never easy for anyone, let alone the political class, it seems many of our longstanding trade partners are reevaluating some of their historically growth-inhibiting policies.

“Our home country has an unprecedented opportunity to build a better and more prosperous future to get some big things done that we just couldn't do before.” Dave McKay, CEO, Royal Bank of Canada

For instance, the European Union intends to expand its defense sector and is moving swiftly to improve trade with India, Canada, and Mexico. Long deemphasized, Canadian leaders are acknowledging the country’s oil and gas resources as valuable assets and entertaining ways to reduce regulatory burdens for exploration and production.

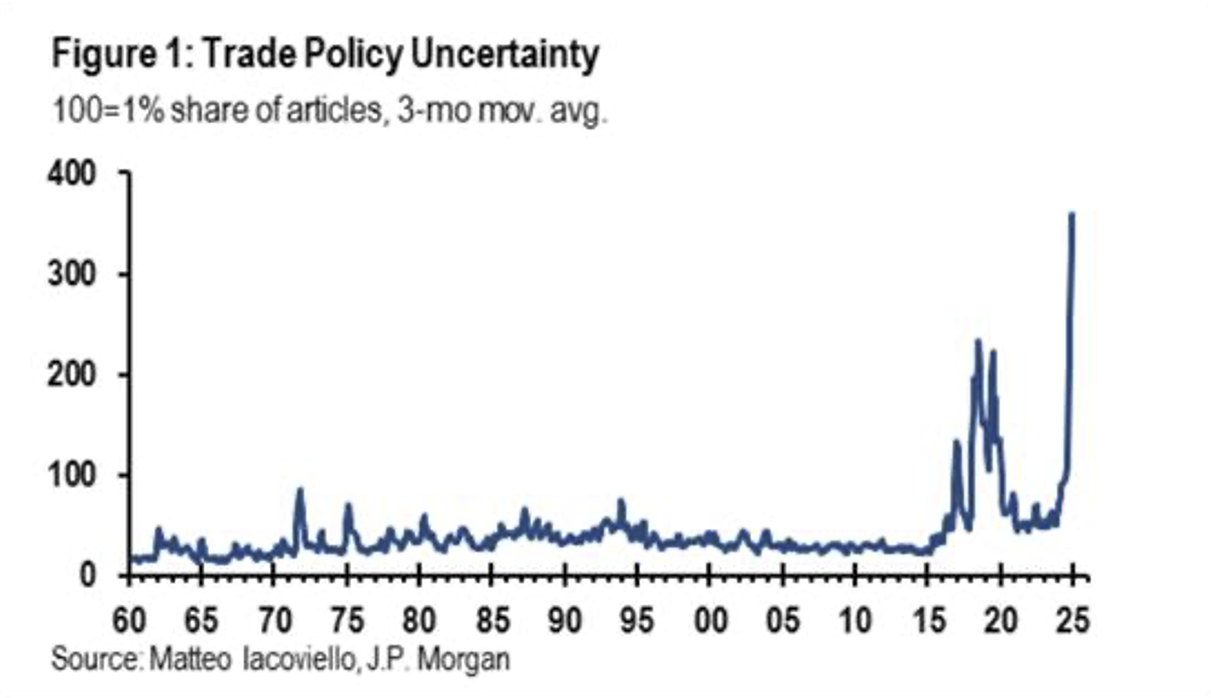

Source: JPM Guide to the Markets, March 31, 2025

Whether this self-reflection produces pro-growth reforms remains to be seen. Moreover, some of Europe’s and Asia's structural challenges, such as declining populations, are not quickly addressed. Nevertheless, it is difficult to dismiss the risks that the rest of the world will increasingly scrutinize and, in some cases, avoid U.S. goods and services when a substitute exists. Considering forty-percent of the S&P 500’s revenues are generated from sales outside the U.S., a sustained shift could prove an unexpected earnings headwind for U.S. companies that have successfully penetrated global markets.

Tariffs: A Few Things to Consider

Historically, the policymaker’s rationale for tariffs includes fairness, job protection, tax revenue, and national security. Neither major U.S. political party has an exclusive on the promotion of tariffs, whose U.S. roots go back to the second law Congress ever passed in 1789!

As for the record, most economic research finds a direct drag on growth. Tariffs are, after all, a tax on goods and historically have sown the seeds of isolationism, which prevents countries from fully capitalizing on their comparative advantages. Put another way, the U.S. would struggle to produce avocados at a lower opportunity cost than Mexico, but our engineers and scientists lead the world in technology and life sciences innovations, which we export around the world.

The other unintended consequence of tariffs is they often serve to protect one segment at the expense of another. As one can imagine, the political sausage of picking domestic industry winners and losers (in swing states and key Congressional districts) is never pretty with the incentives changing with each election. The protection also comes at the expense of innovation and productivity, which impairs the long-term competitiveness of the industries the tariffs intend to support.

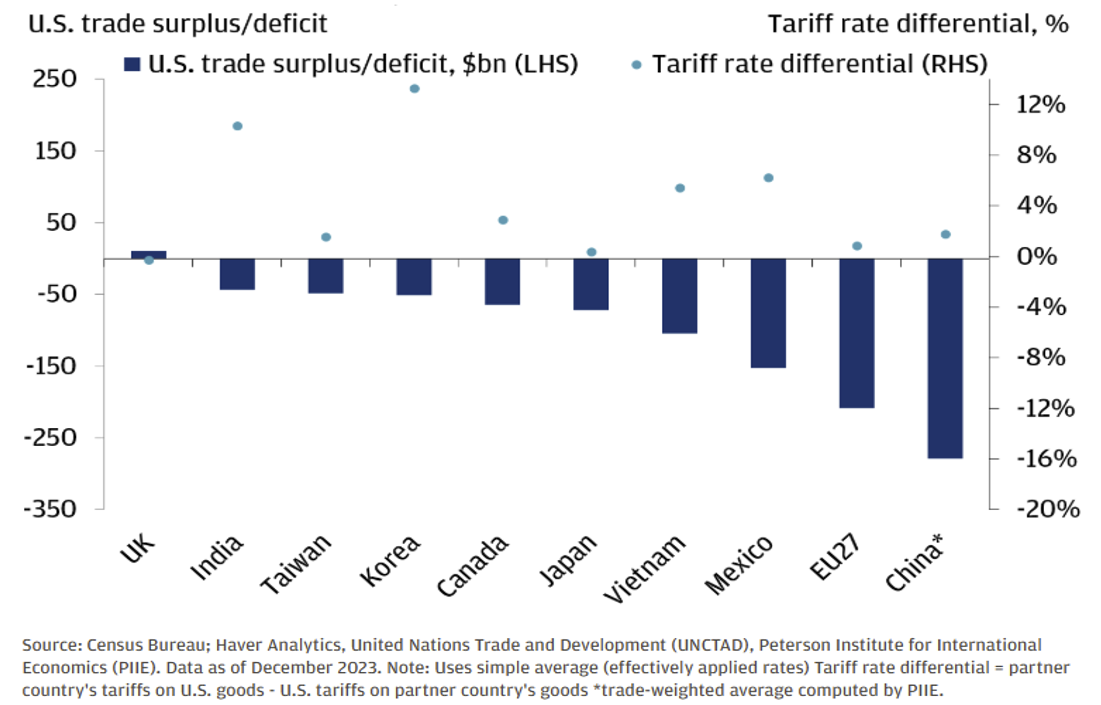

The poor economic record of tariffs does not mean our leaders should forgo negotiating better trade agreements or not try to incent increased domestic manufacturing through reduced regulatory burdens. After all, the importers of U.S. goods levy higher tariffs than the U.S. has historically levied, as outlined in the previous chart. In addition, we experienced the pitfalls of solely sourcing important goods from abroad during COVID.

The risk, however, is if the fairness and desire to “re-shore” manufacturing lead to longstanding protectionist and retaliatory policies. This could dampen the prospects for long-term economic growth, even before considering the potential negative impact to the United States’ service exports, which were over $1 trillion in 2024. Importantly, these service exports are excluded from the U.S.’ often-referenced trade deficit, which only tracks the import and export of goods.

Uncertainties’ Economic Toll Is Rising.

Whether the recently enacted auto or anticipated “Liberation Day” reciprocal tariffs push us into a mild or severe recession remains to be seen. Services are a much larger part of economic activity compared to goods we import and export - 79% in 2023 according to the U.S. Bureau of Economic Analysis. It is also difficult to imagine a member of Congress up for re-election in 2026 wanting to launch a campaign in the face of or on the heels of a recession. This political reality could ultimately influence trade policy and the pace of the Department of Government Efficiency’s efforts to shrink the Federal bureaucracy.

Source: Atlanta Federal Reserve GDPNow, March 28, 2025

It is apparent, however, that the trade war is already impacting global economic growth simply because market participants pause or reduce investment when they cannot forecast the rules. Consistent with this lack of visibility, many Wall Street strategists have reduced the first quarter economic growth outlook from 2.5% to 3.0% late last year to 1-2% currently. The Atlanta Federal Reserve’s unofficial GDP Now real-time tool forecasts negative 2.8% growth for the first quarter, which is a startling reversal from the tool’s 3% estimate in early February. Just this week, two bulge-bracket Wall Street banks increased their probability of a Recession in 2025 to 35% and 40%.

The confidence reversal and growing concerns for the corporate earnings outlook are proving broad-based. Many industrial, consumer, and AI-enthused tech companies have tempered their outlooks in recent weeks. In addition to slowing business investment, a consumer slowdown is afoot. Considering 50% of consumer spending comes from the top 10% of earners, most of whom own stocks, a negative wealth effect of some degree seems in order. (source: Wall Street Journal)

As for corporate earnings, the consensus estimate for the first quarter’s S&P 500 earnings growth is for 4% year-over-year. Just a few months ago, the first quarter estimate was for 7% growth. For the year, analysts still expect EPS growth of 11%, albeit down from the average 15% year-over-year growth forecasted in August. (Source: FactSet)

The equity market’s correction reflects some digestion of the deteriorating economic data. This erosion in the outlook can also be seen in the rally of the Ten-Year U.S. Treasury bond, which now yields 4.2% compared to 4.8% in mid-January. The challenge for investors is understanding how deep a downturn could be, how long it will last, and what today’s lower market prices have discounted. At 20X 2025 earnings compared to near 23X in late February, the expectations bar is lower.

No Substitute for Planning and Identifying the Proper Investment Allocation

Because no one knows the timing, depth, or duration of an economic downturn, we spend considerable time trying to make certain a client’s investment allocation reflects their risk capacity and objectives. We also recognize the emotional toll of riding the market roller coaster, even if the benefits of hanging on are compelling.

Importantly, fixed-income investments and dividend-focused equities have historically offered an important risk mitigator for those clients with shorter time horizons and who prioritize income visibility over capital appreciation. We’ve certainly seen this to start the year. While no drawdown feels great, spending time on the financial plan and establishing the appropriate asset allocation is crucial to reducing investing’s emotional toll and weathering the financial storms.

From the Advisor’s Seat

A few weeks ago, a client emailed to say, “I can’t wait to read Woodmont’s April Market Commentary!” A brief follow-up call revealed the source of the anticipation. The client was somewhat curious about our thoughts on the issues of the day. He was very interested, however, in how we would navigate these topics without appearing political!

Serving hundreds of individual and institutional clients, our investment and wealth management seat offers a unique perspective. One such insight is we regularly observe a client’s sincere conviction that if politics X were to happen Y must happen, only a few minutes later to hear from another client the opposite with equal certainty.

“There are many men of principle in both parties in America, but there is no party of principle.” Alexis de Tocqueville

When convictions are strong and uncertainty the greatest, we have found that our clients’ desire to go and do rarely wavers. Life is short, and we are wired to act. While the activity type and levels may be tweaked during uncertain times, one only needs to be mired in Nashville traffic to understand life goes on. Even more noteworthy is these strong X and Y convictions are unequivocally rooted in hope for the future and devotion to our democratic system. And despite the group’s political differences, we all would welcome one another to our dinner tables and find much in common.

These advisor perspectives won’t smooth what looks to be a rocky road ahead. They do reassure us, however, that we will navigate a path forward, just like when COVID disrupted the world we knew.

As always, if you have questions about your current investment allocation, want to update your financial plan, or if we can help with the tax season rush, please let us know. Thank you for your continued trust and confidence, and all the best for a wonderful spring season.

The Woodmont Team

April 2, 2025

This document contains general information only and is not intended to be relied upon as a forecast, research, investment advice, or a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. The information does not take into account any reader’s financial circumstances or risk tolerance. An assessment should be made as to whether the information is appropriate for you with regard to your objectives, financial situation, present and future needs.

The opinions expressed are of the date of publication and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Woodmont to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecasts made will come to fruition. Any investments named within this material may not necessarily be held in any accounts managed by Woodmont. Reliance upon information in this material is at the sole discretion of the reader. Past performance is no guarantee of future results.